443-815-4591

AffordableBookkeeping.co

Your Trusted

QBO Certified ProAdvisor Experts!

We Specialize In:

QBO Clean-ups: We bring your past finances up to date, ensuring all transactions are accurately recorded and organized.

QBO Catch-ups: We meticulously review and reconcile your QuickBooks data, fixing discrepancies and providing clear financial insights.

QBO Set-ups: We efficiently set up your QuickBooks system, ensuring it's tailored to your business needs and providing you with accurate, tax-ready books.

QuickBooks Cleanup: Your Financial Fresh Start

Messy books? Bank statements don’t match? Transactions missing? You’re not alone. Many businesses struggle with QuickBooks—but that’s where we shine.

✅ We identify & fix errors – No more duplicate transactions or missing expenses.

✅ We organize your accounts – Clean, structured, and easy to understand.

✅ We train your team – Want to learn QuickBooks? We’ll show you how to keep it neat.

Before tax season hits, get your books in order.

One call to AffordableBookkeeping.co could save you hours of frustration—and thousands in missed deductions!

📞 Dial 443-815-4591 today!

2025 QBO Training For

New Business Owners

✅ Avoid Costly Mistakes from Day One

✅ Save Time with Built-In Shortcuts

✅ Gain Confidence with Your Finances

Bookkeeping That Saves You Time & Money

Many small business owners lose thousands of dollars every year due to bookkeeping errors, unclaimed deductions, and financial blind spots. You wouldn’t ignore a leaky pipe in your home—so why ignore cash flow leaks in your business?

At AffordableBookkeeping.co, we help businesses like yours:

🔹 Avoid Costly Mistakes – We make sure your books are accurate, up-to-date, and IRS-compliant.

🔹 Maximize Profits – Spot financial trends, reduce wasteful spending, and make smarter decisions.

🔹 Stay Audit-Ready – No more last-minute scrambling—your books will always be in top shape.

💡 Did you know?

👉 82% of small businesses fail due to cash flow mismanagement. Don’t let that be you!

Who We Help

🏢 Small Business Owners – Stay compliant & profitable with stress-free bookkeeping.

👩⚕️ Freelancers & Self-Employed – Get organized, track expenses, and maximize write-offs.

🏗️ Contractors & Trades – No more lost receipts or underreported income.

🛍️ Retail & E-Commerce – Understand your cash flow & make smarter business decisions.

Whether you’re just starting out or have been in business for years, we make bookkeeping easy!

.

📞 Call now to get started: 410-123-1234

About - COPY

We are committed to providing our clients with the highest quality bookkeeping services. We are also committed to building long-term relationships with our clients, so we can get to know their businesses inside and out and provide them with the best possible support.

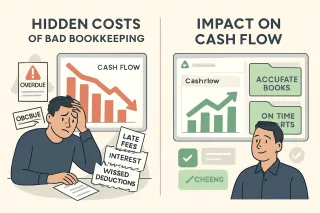

The Cost of Bad Bookkeeping (And How We Save You Money)

❌ Missed tax deductions = Overpaying the IRS

❌ Disorganized books = Wasted time & financial confusion

❌ Inaccurate records = Higher risk of audits & penalties

The Hidden Cost of Messy Books

(Here's what most business owners don't understand!)

The real cost of messy books isn't just annoying – it's potentially catastrophic:

Tax penalties and interest that can run into thousands of dollars

Missed tax deductions that could have saved them significant money

Financial blind spots that lead to poor business decisions

Loan rejections when financial documents don't add up

Audit nightmares that consume weeks of productive time

Cash flow problems from inaccurate financial projections

Don’t let bookkeeping mistakes cost you thousands.

Our expert team ensures your finances are

accurate, tax-ready, and stress-free

all at an affordable rate.

Get Started Today

443-815-4591

🔹 Accurate Books. Lower Stress. More Profit. 🔹

Don’t wait until tax season—take control of your finances now! 🚀

About

We are committed to providing our clients with the highest quality bookkeeping services. We are also committed to building long-term relationships with our clients, so we can get to know their businesses inside and out and provide them with the best possible support.

Services

We Offer Specialized Bookkeeping Services

Categorize Your Transactions

Say goodbye to the shoebox of receipts! We’ll sort, tag, and categorize every transaction with laser precision—so your Profit & Loss and Schedule C aren’t just accurate, they’re beautifully organized. Whether it’s a coffee run, contractor payment, or client deposit, we make sure every dollar has a purpose (and a place).

Come tax time? You’ll be cool, calm, and ready to roll.

Reconcile Your Accounts

Bank statements vs. your books? We make sure they match perfectly. Reconciling your accounts each month helps you spot errors, prevent fraud, and always know exactly where your money stands. It’s like balancing your checkbook—but with zero hassle and all the peace of mind.

Trust us, your future self (and your CPA) will thank you.

Manage Your Financial Statements

Profit & Loss, Balance Sheet...These aren’t just reports—they’re your business’s financial superpowers. We deliver clean, easy-to-read financial statements that tell the real story of your business. Whether it’s tracking profits, monitoring cash flow, or knowing who owes you (and who you owe), we’ve got you covered.

You’ll feel in control and always ready to make smart moves.

A/P & A/R Management

Let’s ditch the stress of bill due dates and overdue invoices. We’ll handle it all—creating bills, sending invoices, tracking payments, and keeping your cash flow on point. No more awkward “just checking in” emails or lost vendor bills.

You focus on running your business—we’ll make sure the money moves like it should.

Expense Categorization

Our team are experts at analyzing bank and credit card transactions in real time and assign them to the correct categories in QuickBooks.

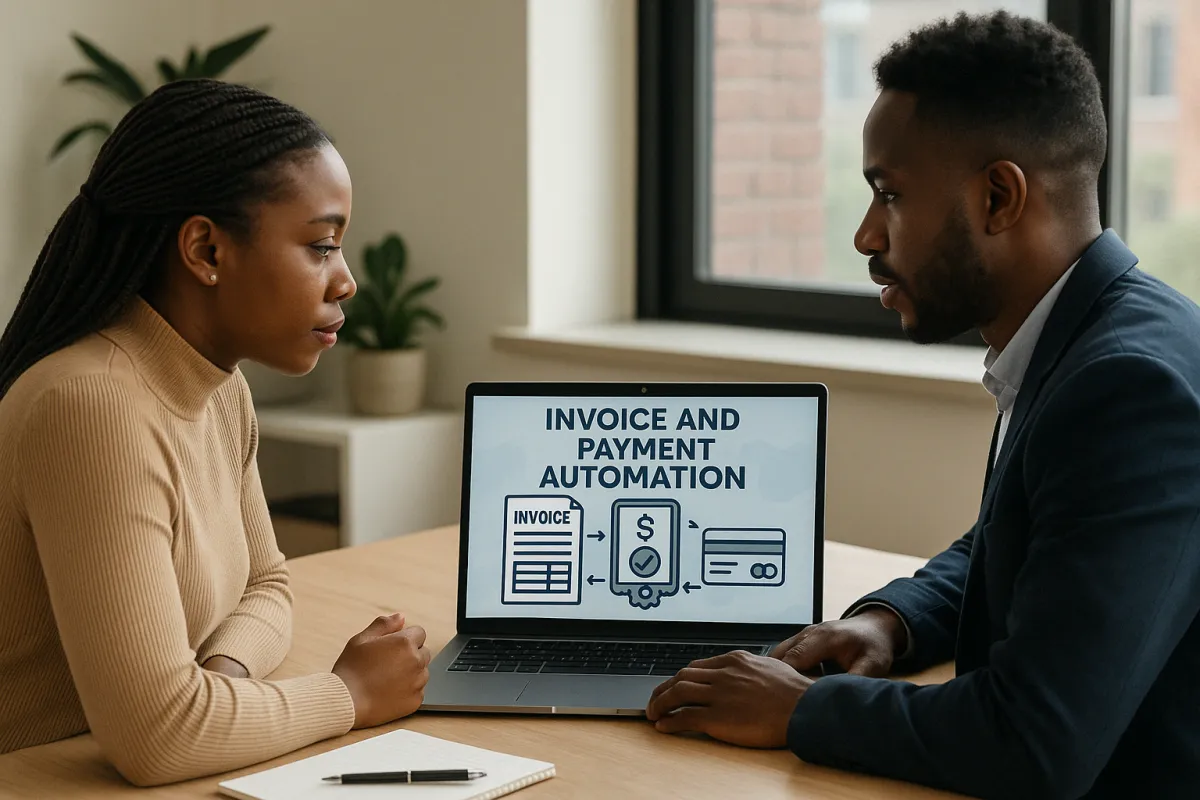

Invoice and Payment Automation

Our customized AI chatbots or email automations can follow up on unpaid invoices, sending reminders and updating QuickBooks once payments are received.

Cash Flow Forecasting

We can build a cash flow dashboard using AI to forecast short-term and long-term cash flow trends, integrating it directly with QuickBooks.

Receipt Scanning and Data Entry

We can integrate with OCR tools to scan and automatically upload receipts into QuickBooks, linking them to the correct expenses.

AI-Powered, CPA Reviewed Financial Insights and Reporting

Our trained AI technology can generate monthly financial summaries with insights and suggestions for improving the financial health of the business, automatically sending these to business owners via email.

Bank Reconciliation

Our custom technology uses AI to flag discrepancies, notify the user, and suggest corrective actions for quick reconciliation.

Payroll Management

We can deliver custom build, AI-powered automations that pull timesheet data, calculate pay, and ensure payroll taxes are correctly applied, then export the data to QuickBooks for processing.

Fraud Detection

We can set up specific real-time fraud detection for your company and alert systems that integrate with QuickBooks to notify users of suspicious activity.

Custom Workflow Automations

We specialize in using tools like Make.com, n8n.com, Zapier, Webhooks, API connections to create custom workflows that integrate QuickBooks with other platforms to automate complex multi-step processes like expense tracking, job costing, and reporting.

Our Blog Articles...

Bookkeeping Mistakes: The Hidden Costs of Bad Bookkeeping

Discover the hidden costs of bad bookkeeping and how neglecting your books for too long can impact your cash flow. Learn the real cost of bad bookkeeping, common mistakes, and practical ways to fix yo... ...more

Quickbooks Online Basics

January 30, 2026•4 min read

Profit and Loss Statement Explained for Accurate Reporting

A profit and loss statement helps small business owners spot accounting and bookkeeping discrepancies caused by incorrect transactions in QuickBooks. ...more

Quickbooks Online Basics

January 26, 2026•4 min read

How to Prepare for a Small Business Audit

Master the art of small business audit preparation with this detailed guide. Ensure compliance and accuracy for a seamless audit process. ...more

Planning & Forecasting

January 24, 2026•11 min read

Testimonials

We Are Trusted Over 16+ Countries Worldwide

I was so overwhelmed with my bookkeeping that I was falling behind on my taxes and other financial obligations.He was able to get my books in order quickly and efficiently.

JANE DOE

I am so grateful for [bookkeeper's name]'s bookkeeping services. She has taken all of the stress out of managing my finances and I can now focus on running my business.

JANE DOE

FAQS

What’s the difference between a bookkeeper and an accountant?

A bookkeeper handles day-to-day financial transactions, bank reconciliations, and monthly reports. An accountant typically focuses on tax filing and strategic planning. Bookkeepers keep the financial engine running smoothly so accountants can do their job effectively.

How do I know if I need a bookkeeping "Catch-Up", "Clean-Up", or both?

You may need:

* Clean Up if you’ve missed several months or years of bookkeeping entirely, and your books contain errors and are inaccurate.

* Catch Up if your books are up to date but you have not entered information in months.

* Both if your books are behind and incomplete, and the data that’s already in there has errors and is inaccurate.

What kind of businesses do you work with?

We work with a variety of small businesses, including home services (plumbers, electricians, etc.), restaurants, professional services firms, online businesses and solopreneurs.

Why do I need a bookkeeper if I already have accounting software like QuickBooks?

While software helps with data entry and automation, a bookkeeper ensures your records are accurate, reconciled, categorized correctly, and compliant with tax laws. We turn your raw numbers into meaningful insights. We are Certified Quickbooks ProAdvisors.

How often do I need bookkeeping services?

It depends on your business needs. Most clients opt for monthly services to keep books clean and ready for taxes. Others, especially high-volume businesses, may need weekly attention. We will discuss with you during our "discovery meeting".

How do you ensure the security of my financial information?

We use encrypted, cloud-based platforms, two-factor authentication, and strict internal policies to ensure your financial data is safe and confidential. For example, DO NOT send us ANY information via email. All of our clients send information thru the Quickbooks portal. This ensures all of your information is protected. Remember, sending ANY information sent via email is like sending physical mail with a clear envelope. DON'T DO THAT!

Can you help me clean up messy or backlogged books?

Absolutely. We specialize in cleanup projects—whether you're months or even years behind, we’ll get your books current and accurate, fast. Our team has specialize training, specifically in clean up projects. See, you have to be the BEST to do clean up work because you have to be an expert in several different areas/scenarios. Make sense?

How much do bookkeeping services cost?

Pricing depends on the size and complexity of your business, but we offer flat-rate packages so you always know what you’re paying—no surprise invoices.

This is wonderful news for you because some of our clients really complained about about bookkeepers inflating hours. You do not have to worry about that with us. One flat rate each month!

Will I be able to access my books anytime?

Yes! We work with Quickbooks Online, so you can access your real-time financials from anywhere, anytime, 24/7. Make sure you install the proper Quickbooks app, from the app store...which is 100% FREE!

Can you work with my CPA or tax preparer?

Definitely. We can collaborate with your accountant or CPA to ensure year-end tax prep is smooth, accurate, and hassle-free. Much of our staff members are CPAs (including our Managing Director) and we understand things from the CPA's and Tax Preparer's point of view.

What do you need from me to get started?

Just a quick discovery call, and a 30 minute discussion about your current bookkeeping situation. We handle the rest! You are in good hands!

Our Team

Meet Our Professional Team

RON CARTER, MBA, CPA

Managing Director

Andrew Cohen

Director

Kaarina Jarvin

Client Services

Contact Info

Email: [email protected]

Headquarters: Owings Mills, Maryland

Phone: 443-815-4591

Assistance Hours :

Mon – Sat 10:00am - 5:00pm

Sunday – CLOSED