Bookkeeping Mistakes: The Hidden Costs of Bad Bookkeeping

The Cost of Bad Bookkeeping Goes Too Long

Bookkeeping is a vital aspect of running any business, whether large or small. It forms the backbone of financial management, ensuring that a company remains compliant with tax regulations and financial reporting standards. However, bad bookkeeping often goes unnoticed until it spirals out of control—leading to serious ramifications for the business, including potential audits.

Many entrepreneurs underestimate the importance of maintaining accurate financial records, believing that they can simply address any discrepancies later. Unfortunately, this neglect can lead to hidden costs that significantly impact the bottom line.

What Counts as Poor Bookkeeping?

Bad bookkeeping can manifest in several ways, and recognizing these pitfalls is essential for every business owner. Common bookkeeping mistakes include:

Lack of Organization: Disorganized files and missing receipts can create a chaotic financial environment, making it harder to track expenses and income accurately.

Misclassification of Expenses and Revenue in a small business can lead to significant financial issues.: Assigning expenses and revenue to the wrong categories in financial data can lead to distorted financial statements and tax issues, including fines from the IRS.

Ignoring Regular Financial Reviews: Failing to periodically review financial records can prevent early detection of inaccuracies and lead to larger problems down the line.

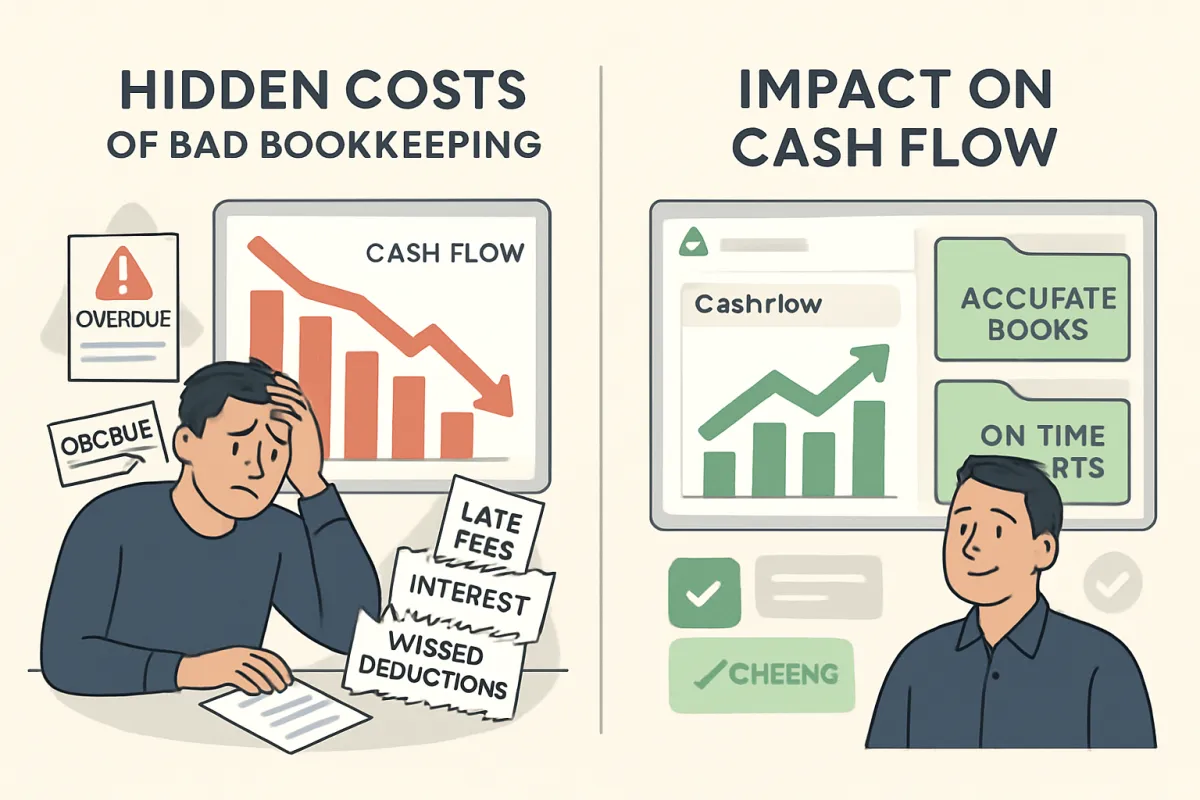

The Hidden Costs of Bad Bookkeeping

The consequences of bad bookkeeping can result in various hidden costs that accumulate over time, including fines and lost opportunities for small businesses.

Errors Leading to Tax Issues: Mistakes in your bookkeeping can lead to overpaying or underpaying taxes, causing headaches during tax season.

Late Fees and Penalties: Missing deadlines or failing to comply with regulations can incur unnecessary late fees and penalties, further straining finances.

Missed Deductions: Inaccurate records can cause you to overlook valuable deductions, which means higher tax bills and lower profitability.

Accounting Cleanup Costs: Rectifying poor bookkeeping often requires significant time and resources, making the process time-consuming and leading to additional costs for accounting cleanups or outsourcing accounting services.

Hidden Costs | How Bad Bookkeeping Impacts Cash Flow

Cash flow is the lifeblood of any business, and poor bookkeeping can severely impact it:

Incorrect Cash Flow Projections: Bad records can lead to erroneous cash flow forecasts, making it difficult for small businesses to plan for future expenses and meet IRS requirements.

Misjudging Available Funds: Without accurate tracking, businesses might miscalculate how much cash is on hand, leading to poor financial decisions.

Cash Shortages: Delayed or inaccurate invoicing can create cash shortages, hindering the company's ability to meet its obligations.

Impact on Supplier Payments: Inaccurate cash flow management can strain relationships with suppliers and affect overall business operations.

Long-Term Consequences of Neglecting Bookkeeping

Neglecting good bookkeeping practices can have long-lasting implications:

Poor Financial Decision-Making can stem from inaccurate financials. Erroneous data can lead to bad strategic decisions, which may jeopardize the business's success and attract the attention of the IRS.

Loss of Investor or Lender Confidence can result from poor financials and mismanaged bookkeeping practices. Inaccurate financial records can undermine trust with current or potential investors and lenders, complicating future funding opportunities.

Operational Inefficiencies: A lack of proper record-keeping in a small business can create inefficiencies in various business operations, ultimately affecting profitability and leading to potential audits.

Reduced Profitability Over Time: Over time, the cumulative effects of poor bookkeeping can lead to diminished profits and even business failure.

How to Fix Bad Bookkeeping Before It Gets Worse

If you find yourself in a bad bookkeeping situation, it's essential to act quickly:

Set Up Proper Bookkeeping Systems: Implement systems that ensure proper record-keeping from the start, minimizing future errors.

Use Bookkeeping Tools or Software to streamline your accounting service and reduce the risk of errors.: Leverage technology to automate accounting tasks and provide real-time insights into your financial situation, thus reducing the time-consuming nature of bookkeeping.

Hire a Professional Bookkeeper or Accountant: If bookkeeping becomes overwhelming, consider hiring an expert to manage your financial records accurately.

Create Consistent Financial Review Habits: Schedule regular reviews of your financial statements to catch errors early and stay on top of your finances.

Conclusion

In conclusion, the costs of letting bad bookkeeping go unchecked can be steep for any business. By identifying the signs of poor bookkeeping and implementing effective solutions, you can protect your business’s financial health and ensure its long-term success.